A sole proprietorship is a type of business organization that is owned, managed, and controlled by a single person who receives all profits and bears all risks.

Due to a lack of government regulation, a sole proprietorship is the simplest type of business to establish or dissolve. As a result, these types of businesses are extremely popular among sole proprietors, individual self-contractors, and consultants. Most small businesses begin as sole proprietorships and either remain that way or grow to become a limited liability entity or corporation.

Some of India’s largest existing businesses, including Flipkart, did begin as sole proprietorships. Moreover, some of the most well-known business names in the world began with a single owner. Coca-Cola, Amazon, the Walt Disney Corporation, and toy giant Mattel are all examples of sole proprietorships.

Features Of sole proprietorship

There are so many features of sole proprietorship which describe this form of business. Features are mentioned below.

- Control

The company is owned by a single person. A sole proprietor has complete control over his company. Although, he is free to carry out his plans without interference from others.

- Formation and closer

- This type of business organisation is formed by the owner itself.

- There are no legal basic requirements for forming a sole proprietorship.

- In some cases, legal formalities are required, or the owner must have a specific licence or certificate to operate the business.

- The owner has the authority to close the business at any time.

- Unlimited Liability

In the circumstance of a business loss, if the business assets are insufficient to cover all business liabilities, the proprietor may be forced to sell personal property to cover the losses.

- The sole bearer of risk and profit

A sole proprietor is personally liable for all risks. If there are losses, he must bear them alone. If the company succeeds, he is the sole recipient of all rewards and profits.

- No Separate Entity

According to the accounting system, the owner and the business are two distinct entities. But, there is no distinction between the sole trader and his business in the eyes of the law. As a result, the business has no identity without the sole trader because he is the only person who performs all business activities.

- Lack of Business Continuity

Because the owner and the business are the same, the sole trader’s death, insanity, imprisonment, or bankruptcy will result in the closure of the business.

Also Read: Amazing Business Ideas with Solar Panels

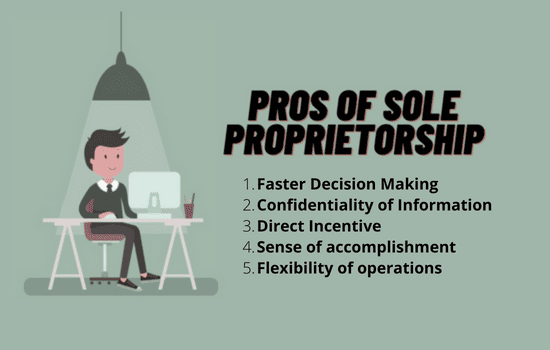

Pros of Sole Proprietorship

Some of the most well-known benefits of a sole proprietorship are as follows.

- Faster Decision Making

A sole proprietorship enjoys full freedom in making business decisions without consulting others.

- Confidentiality of Information

A sole proprietorship can keep all business information confidential and maintain secrecy. He/She is not bound by law to publish the accounts of his business.

- Ease of Formation & Closure

Starting a sole proprietorship requires almost no legal formalities. Closure of business can be also done easily.

- Direct Incentive

A sole proprietorship directly gets the benefits of his/her efforts as he/she is the sole receiver of all the profits.

- Sense of accomplishment

If the firm is successful, it boosts to self-confidence of the sole proprietor and gives a sense of accomplishment in him/her.

- Flexibility of operations

In a proprietorship business, all decisions are taken by a single person. There are no delays and the business can quickly adapt itself to the changing environment. This provides flexibility to the business.

Also Read: Smart Steps of web Designing for your business website

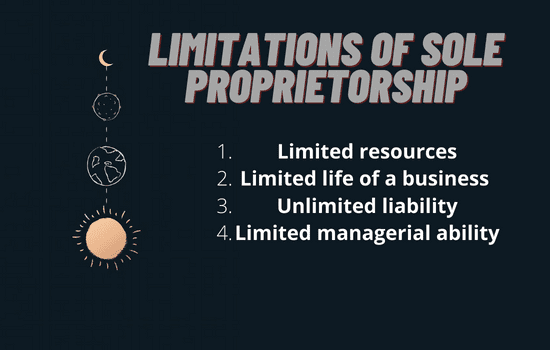

Limitations of Sole Proprietorship

The following are some of the primary limitations of a sole proprietorship:

- Limited resources

The resources of a sole proprietor are limited to personal savings and borrowings from others. However, Banks and other lending institutions may be hesitant to give a sole proprietor a long-term loan.

- Limited life of a business

Because the owner and the business are the same entity, the sole proprietor’s death, insanity, imprisonment, physical ailment, or bankruptcy will result in the closure of the business.

- Unlimited liability

Sole proprietors have unlimited liability. In the event of a business loss, if the business assets are insufficient to cover all business liabilities, the proprietor may be forced to sell personal property to cover the losses.

- Limited managerial ability

All managerial tasks, such as purchasing, selling, and financing, must be performed by the owner. He may be unable to hire talented employees due to a lack of resources.

Suitability

A sole proprietorship generally requires less capital. It is ideal for the following sectors:

- Businesses that operate on a small scale with limited capital and managerial talent, such as local grocery stores, medical stores, bakeries, small factories, and so on.

- Small beauty salons, hair-cutting salons, tailoring units, dry cleaners, Internet cafes, and other businesses where customers expect personalized services.

- Businesses that produce artistic goods, such as embroidery, craft centers, etc.

- Businesses with limited risk, i.e., less fluctuation in price and demand, such as stationery stores.

Also Read: Effective Advertising strategies to promote businesses

Tax Filing of Sole Proprietorship

A sole proprietorship’s legal status can be defined as follows:

- In the books of companies act, sole proprietorship do not have any separate legal laws.

- The owner’s liability is boundless (i.e. the sole proprietorship’s debts and losses are personally liable for the business owner).

- It has the authority to sue or be sued in the owner’s name.

As a result, Sole proprietors file personal tax returns and pay income and self-employment taxes on their profits. When filing taxes as a sole proprietor, you must complete the standard tax Form 1040 for individual taxes as well as Schedule C, which reports your business’s profits and losses. The amount of taxes you owe will be determined by combining your Form 1040 and Schedule C income. There will be additional forms to complete if you have employees.

Conclusion

A sole proprietorship is a straightforward way for an individual to start a business. In Most cases do not necessitate registering with a state agency or obtaining an EIN from the IRS.

The advantages of simplicity are accompanied by some disadvantages, such as all liabilities being passed through from the business to the individual and funding being more difficult to obtain. Those risks should not be too concerning at first. However, as the company grows, it is necessary to switch to a different legal structure.

Also Read: Digital Process Automation: How it Benefits Companies