UPI stands for Unified Payment Interface. It has grown to be a very important source in the modern world. Many people around the world use UPI to make day-to-day payments. People also use UPI to transfer money. When we buy something, we use UPI to make payments, which makes payments very simple. So far, money is directly debited from your account or debit card when you make a UPI payment. This means that UPI will become more popular and widely used. In addition, the RBI has announced a linking UPI with credit card in their monetary policy committee report.

The issue for many people is that they use credit cards. As a result, they must eventually make payments through POS by swiping their credit card. But, on occasion, If a POS machine is available for payment, the individual must transfer funds from their bank account. As a result, it becomes more difficult.

Now, the RBI has announced that credit card payments can process via UPI. That means that if you don’t have enough money in your bank account but have my credit card. You can transfer or pay using UPI. Prior to this notification, people made payments directly from their bank accounts.

Statement of Reserve Bank of India

So, to begin our main discussion, what exactly happened? As a result, the Reserve Bank of India (RBI) allowed users to link their cards to Unified Payments Interface (UPI) platforms on Wednesday. So, previously, we could only connect our savings or current account through UPI to make payments. But now, thanks to this notification, we can also connect our credit cards through UPI.

- When we open a new bank account and we only receive a debit card, and when we use UPI to make a payment. The amount is debited from the debit card, so the debit card is ultimately linked with the bank account.

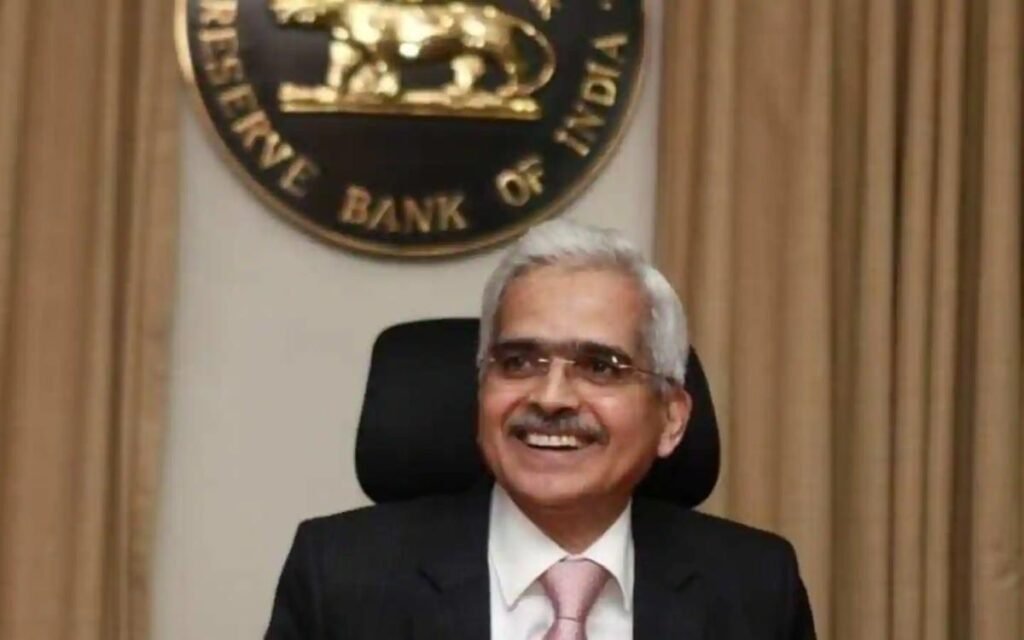

- The RBI’s governor, Shaktikanta Das, announced on June 8 that the facility will begin with the indigenous Rupay credit card.

- Das went on to say that the goal is to give customers more convenience and expand the scope of digital payments.

- What advantages will it provide to users? Initially, UPI payments could only be made through bank accounts. Later, UPI applications began to allow users to add debit cards in order to make payments.

- Users can now link their credit cards to popular UPI applications like Google Pay, Paytm, PhonePe, and others.

- After linking the credit cards, users must scan the QR code and select the credit card as the payment mode.

- Credit limits for UPI transactions have been restricted to a small number of applications and banks. However, with the most recent announcement, the RBI has made the UPI credit facility available to all players.

Also read: Diners Club Credit Card and Benefits

UPI Linking With Credit Card For Payment

- Initially, only RuPay credit card holders were able to link their cards to UPI platforms.

- The RuPay credit card is currently available from Punjab National Bank (PNB), IDBI Bank (IDBI), Union Bank, State Bank of India (SBI), Bank of Baroda, Federal Bank, and Saraswat Co-operative Bank.

- It should be noted that the National Payments Corporation of India manages both the RuPay network and UPI (NPCI).

- “This facility should available once the necessary system development had completed. Separate instructions have been issued to NPCI”. In a statement, the central bank stated.

- Individuals who use other credit cards, such as Visa or MasterCard, will have to wait a little longer.

Also Read:- How to reset the UPI pin

Benefits to Merchants by UPI Linking With Credit Card

WILL MERCHANTS BENEFIT FROM IT? According to experts, linking UPI and credit cards will be extremely beneficial for small merchants. “Along with being a very consumer-friendly development. This will benefit small merchants as well as the largest UPI acquirers such as PhonePe, Paytm, Bharat Pe, and others.

- Cards can now effectively used to pay at the ubiquitous QR codes. Eliminating the need for costly POS machines “Ankit Gera, Junio’s co-founder, stated.

- The central bank has not yet announced any fees for using credit cards to make UPI payments. Banks or lenders, on the other hand, may charge a small fee for linking credit cards to UPI platforms.

- According to a rule that went into effect on January 1, 2020, UPI and RuPay are subject to a zero-MDR (merchant discount rate), which means that no fees can applied to these transactions.

- MDR is a fee levied on merchants for accepting payments via UPI, digital wallets, debit, and credit cards.

- Credit cards currently have the highest MDR, ranging between 2% and 3%. It will be interesting to see what fees a merchant charges for accepting credit cards via UPI.

GROWTH oF UPI

- UPI is quickly becoming the default payment mechanism, with the most recent benchmark of Rs 10.4 lakh crore in UPI transactions processed in May 2022.

- UPI processed 594.63 crore transactions totaling Rs 10.40 lakh crore in May 2022 alone.

- With over 26 crore unique users and five crore merchants on the platform, UPI has become India’s most inclusive mode of payment.

- In March, the RBI even launched UPI for feature phones, bringing approximately 400 million feature phone users into India’s homegrown payments network.

- Feature phones are simple phones that typically offer voice calling and text messaging capabilities.

Also Read:- RBI New Guideline: Repo Rate Increases by 50 Base Points

CONCLUSION

According to the latest PhonePe and Boston Consulting Group study, India’s digital payment market will more than triple to $10 trillion by 2026. (BCG). Currently, 40 percent of all transactions in India are digital, and digital instruments processed $3 trillion in payments in 2021. QR-code payments are now accepted by over 30 million merchants in the country, a significant increase from 2.5 million merchants five years ago.